The company receives prompt payment of outstanding debts, retains liquidity, and can continue to operate – that is, make new credit sales. The receivables daily turnover ratio is computed.Ī high turnover ratio is advantageous to a firm since it suggests that the interval between credit sales and payment is reasonable. But what is the receivables turnover ratio? It is an activity ratio that assesses a company’s efficiency in extending credit to its customers (as measured by net credit sales) and recovering money owed to the company (measured in average accounts receivables). The accounts receivable turnover ratio is also known as the receivables turnover ratio or simply the turnover ratio. Accounts receivable is the legal claim that customers will pay for the product, and receivables turnover ratio is a related metric that reflects its efficiency.

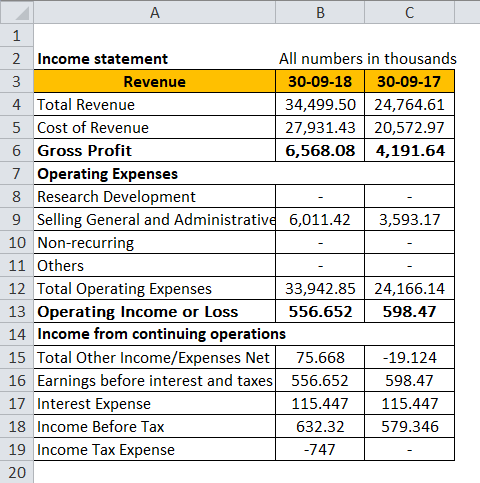

To keep track of the cash flow (money movement), it must be recorded in the accounting records (bookkeeping is an integral part of healthy business activity). Net credit sales are the revenues generated when a company sells its goods or services on credit on a given day – the product is sold, but the money will be paid later. Isn’t it straightforward? Sure, as long as you get paid or pay in cash, the act of buying or selling is immediately followed by payment.īut what happens if you pay with a credit card? You still get your items, but the payment is deferred or postponed.Īccounting follows the same process. Do you want that delicious pizza slice? You’ll have to buy it right away, which means you’ll have to pay for it. When you sell something, you are usually paid immediately. If you want to quickly understand what the accounts receivables turnover ratio formula is but don’t want to be overwhelmed by a brain of accounting words, let’s go back a little bit and start at the beginning. You’ll also learn what a high or low turnover ratio signifies and the consequences of each.

#RECEIVABLE TURNOVER RATIO FORMULA HOW TO#

This article will define receivables turnover ratio and show you how to calculate it with the accounts receivable turnover ratio formula. The turnover ratio is a metric that measures a company’s capacity to provide credit as well as collect debt. The accounts receivable turnover calculator is a simple tool for calculating the accounts receivable turnover ratio.

0 kommentar(er)

0 kommentar(er)